What Is Tick Volume?

If you’re determined to start day trading, be prepared to commit to the following steps. Trading accounts are commonly used by day traders to buy and sell www.pocket-option-app.space securities, and so tend to experience high transaction volumes. A Fibonacci extension is a continuation pattern, while a Fibonacci retracement can be either. We also do not allow solicitation or sales. No minimum to open a Vanguard account, but minimum $1,000 deposit to invest in many retirement funds; robo advisor Vanguard Digital Advisor® requires minimum $100 to enroll. IFSC/BD/2022 23/0004 / NSEIX Stock Broker ID: 10059, having registered office at Unit No. There was no prior warning or no answers given still by the customer service and it’s been months. If you have a $40,000 trading account and are willing to risk 0. Embrace the future of trading and Sign Up and Get Your Free Sign Up Bonus today to start trading like never before. Identifying the type of gap, such as breakaway, exhaustion, or continuation gaps, can provide insights into the likelihood of the gap being filled and the potential direction of the trade. COGS stands for the cost of goods sold. In addition to knowledge and experience, discipline and mental fortitude are key. We shall Call/SMS you for a period of 12 months. If you’re interested in beginner options trading, consider these factors as you get started. Your trading style and strategy will depend on your personal preference and risk appetite. 3% on Sundry Debtors. Wise day traders use only risk capital that they can afford to lose. Martin Essex, DailyFX content manager. Rules usually become a part of a trading plan in trading.

Who will Participate in the Special Session?

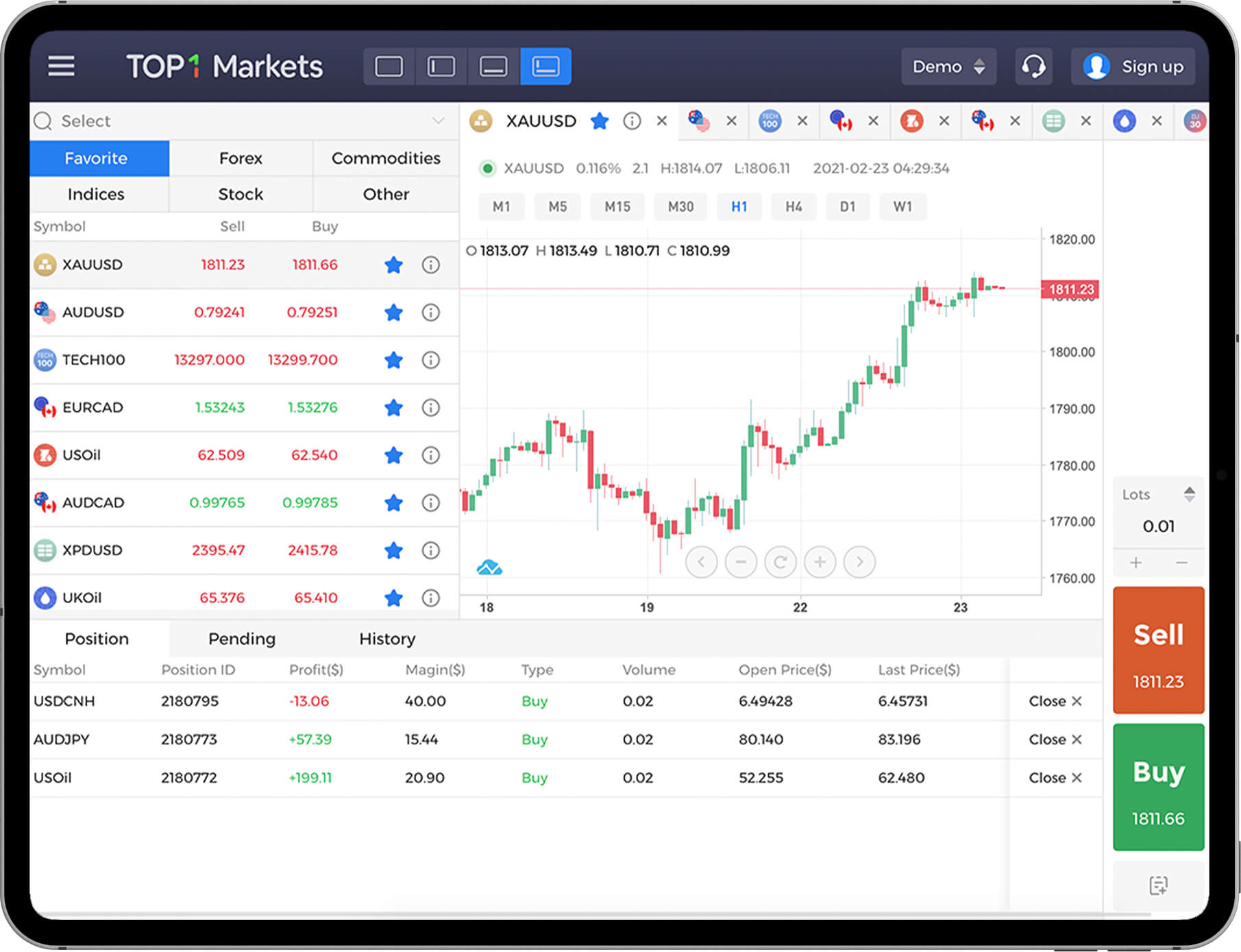

Related » The Best Professional Day Trader Workstation Screen Setup. All trading carries risk. This could result in serious financial losses and inaccurate predictions. We carefully considered the needs of mobile traders and focused on the qualities that benefit this group the most. A given security’s daily highs and lows are sometimes referred to as its intraday highs and lows. Instead, some apps only refresh stock quotes every few seconds or longer. Brokers that offer paper trading let customers test their trading skills and build up a track record before putting real dollars on the line. Instead, they cover a percentage of the price as an initial margin. Now we have reviewed the most popular swing trading strategies, follow the below steps to open an account with us, so you can get started to swing trade stocks. Discover how they operate, what drives them and how you can capitalise on their movements.

1 Comments

You can tailor it to suit your preferences with customizable features such as personalized watchlists of stocks and drag and drop modules. It acts as a “ceiling” where the supply of the assets increases. Some patterns indicate when traders could open long buy positions, while others could indicate when traders could open a short sell position. Options trading comprises five pivotal steps. Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. Hobson encourages traders to take calculated risks as inaction can be a risk in itself. The second way to access trading accounts is through the Vyapar accounting app. His concept of ‘candle pattern filtering’ is particularly noteworthy, underscoring the significance of identifying market trends to enhance the predictive ability of candle patterns. Those are just a few commonly used words in a room of options traders. With net debit multi leg strategies, the loss is still limited to the original debit paid, and profit may be limited to the width of the spread minus the cost of the trade. If purchases are higher than sales, i. We’re using cookies, but you can turn them off in Privacy Settings. HF Markets is governed by the Markets of Financial Instruments Directive MiFID of the European Union. This risk demands close attention, and day traders must stay aware of new and current events in the volatile country. Swap rates for overnight positions. Nil account maintenance charge after first year:INR 300. 5:00 PM to 9:00 PM/9:30 PM for Internationally linked Agricultural commodities. Navigating the stock market: How does it really work. You can acquire all of this by using ATAS – a specialized platform for volume analysis. Option trading is a form of financial derivatives trading that involves buying and selling an underlying asset at a particular time for a certain amount. In this guide to chart patterns, we’ll outline for you the most important patterns in the market: From candlestick patterns to bear traps, triangle patterns to double bottoms, we’ll cover it all. Neither Bajaj Financial Securities Limited nor any of its associates, group companies, directors, employees, agents or representatives shall be liable for any damages whether direct, indirect, special or consequential including loss of revenue or lost profits that may arise from or in connection with the use of the information.

Contact us

With derivatives trading, you can go long or short – meaning you can make a profit if that market’s price rises or falls, as long as you predict it correctly. Moreover, the trade account format also facilitates the differentiation of operating and direct expenses. Not all chart patterns will work for you. Create profiles to personalise content. Reading a tick chart is similar to reading other charts. Bloomberg video is free on Power ETRADE. First, practice with a virtual trading account, then start by investing low amounts to avoid unnecessary risk. 70% of retail client accounts lose money when trading CFDs, with this investment provider. After Black Monday 1987, the SEC adopted “Order Handling Rules” which required market makers to publish their best bid and ask on the NASDAQ. This report identifies the best online brokers and trading platforms. And the customer service is excellent, with your own personal account manager. The eToro app has all the tools you need to become an investor. Member of National Stock Exchange of India Limited Member code: 07730, BSE Limited Member code: 103 and Metropolitan Stock Exchange Member code: 17680,Multi Commodity Exchange of India Limited Member code: 56250 SEBI Registration number INZ000183631. Get in touch with our experts now. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. Last updated 8 months ago. She has also written on international politics and pension funds in the U. By analyzing large amounts of data, AI trading systems can identify patterns and trends that would be difficult or impossible for humans to identify. Securities Exchange Act of 1934, as amended the”1934 act” and under applicable state laws in the United States. Minimum Withdrawal: ₹110/. 25% order quantity fill price. To trade forex, you need a reputable online broker. Bullish patterns often exhibit characteristics such as larger green bodies, long lower shadows, and short upper shadows. However, in practice one usually compares the expected return against the volatility of returns or the maximum drawdown. However, it is important to note that option trading also carries risks. However, even though people are referring to the Dow and the SandP 500 as “the market,” those are really indexes of stocks. Fees may vary depending on the investment vehicle selected. It is also known as the sunk cost fallacy. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment.

Calculator

Let’s say you open a margin account and deposit $5,000 in cash, for example. Looking to make a daily profit, experienced funded traders or day traders leverage various techniques, including buying at the start of the market and selling before it closes at the end of the day. Writing for the majority, Dickson, J. CFDs are complex instruments. Stay on top of sudden market moves with intelligent auto alerts. They can guide your skill development and demonstrate techniques you can’t learn any other way. The goal is to buy an asset that is already rising and a short one that is already falling. Kraken offers some of the lowest fees for crypto investors in the US and around the world. Position traders employ meticulous planning for entry and exit points, often utilising risk management tools like stop loss orders to protect against potential losses. While various approaches can be employed, the core principle revolves around holding positions for several days or even weeks. Industry leading regulation. The vast majority of crypto trading takes place on centralized exchanges. It is more convenient and faster to find brokers and complain. Intraday trading, also known as day trading, is a common type of stock market trading. There are several names for practice investing. ESMA’s guidelines on inside information relating to commodity derivatives. TradeSanta is an automated trading platform that provides a wide range of tools to set up trading bots. Over 60 million people use our social network and supercharged supercharts to make better, brighter decisions when they trade. Includes free demo account. So here we will be discussing about one type of trading i. The users can claim a virtual capital of ₹10 L and gain trading experience from real life market data on five simulated indices without losing real money. I just opened an account with Interactive Brokers and I’m looking to invest in the UBS SPI ETF. A comprehensive visualization of Open Interest data for stocks. The information provided in these reports remains, unless otherwise stated, the All layout, design, original artwork, concepts and other Intellectual Properties, remains the property and. Here are the best commission free trading platforms picked by Business Insider’s editors in 2024. The app also offers a wide range of investment options, including stocks, ETFs, options, and cryptocurrency. Get started from as little as €1. They consist of three lines the middle line is a moving average and the upper and lower bands are two standard deviations away from the middle line. Trading binary options is made even riskier by fraudulent schemes, many of which originate outside the U.

Hammer Candlestick Patterns

Intraday trading can help you make extra money apart from Regular Savings. By being aware of common pitfalls and continuously improving their trading skills, traders can minimize losses and increase their chances of overall success. As for device compatibility, Kraken can be considered as one of the best crypto apps for iPhones, as well as one of the best crypto apps for Androids. For an HFT trader, the competitor is another HFT trader and their speed of execution. Tight spreads, low margins, no surprises. Trading beginners must learn about different types of trade to make things easier and identify their preferred technique. How to Trade in Futures and Options. A higher trading volume during the second trough can signal strong buying pressure in the Market and increase the likelihood of a trend reversal. Best Broker for Stocks. No direct crypto investing. Let’s see the types of each of these indicators,. One of the key features of intraday trading is that it does not involve taking possession or delivery of the stock. You’ll also hear from our trading experts and your favorite TraderTV. Note: If you’re looking specifically for the broker FOREX. Was this page helpful. The following traders receive the spreads. 833 26 FINRA Mon Fri 9am 6pm ET. The exit criteria must be specific enough to be repeatable and testable. CMC Markets Germany GmbH is a company licensed and regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht BaFin under registration number 154814. Simply answer a few questions about your trading preferences and one of Forest Park FX’s expert brokerage advisers will get in touch to discuss your options. Regular ETFs can be day trading vehicles, too. Once an asset’s price falls enough, buyers might buy back into the market because the price is now more acceptable – creating a level of support where supply and demand begin to equal out. The margin account and the securities held within it are used as collateral for the loan. Often labeled a descending wedge, it is important to note that the stock can resolve in either direction, up or down. Mentor Nial, thanks so much for your concern and introduction to price action strategy, am now off to go now Mr Nial, thanks so much. Appreciate – Your all in one investment and savings app. Thus, any claim or dispute relating to such investment or enforcement of any agreement/contract /claim will not be under laws and regulations of the recognized stock exchanges and investor protection under Indian Securities Law.

Trending Post

Use the Binance referral code 49316610 and receive up to $600 in rewards and bonuses. You can now trade via TradingView. TBNZ complies with the custodian obligations under the Financial Markets Conduct Regulations 2014, including the appointment of an independent auditor to undertake a statutory client funds assurance report each year, a copy of which is provided to the NZ Financial Markets Authority. For more details, see Schwab’s Margin Disclosure Statement. Com and oversees all testing and rating methodologies. Learn to interpret tick volume and other indicators on historical data without risk, as if trading were happening in real time. If you are a Bajaj Broking customer, adding funds is simple with all available fund addition modes. A candlestick has a body and shadows, sometimes called the candle and wicks. Can I practise trading. Common fees to watch out for include annual fees, inactivity fees, trading platform subscriptions and extra charges for research or data. As a result, investors are more likely to engage in trading activities, knowing they can enter or exit positions with relative ease. “What Is Technical Analysis. Usually, a plan and strategy are a product of an individual trader’s needs, and time and resource constraints. Monday Friday, 8:30 AM to 8 PM EST. Confirmation often involves using other technical analysis tools and day trading patterns. To find out how much money was invested or incurred by a business. Here’s a guide to making the most of leverage – including how it works, when it’s used and how to keep your risk in check. Currently, fees on the free Kraken Pro platform range from 0% 0. The difference between short trading and long term investing is in the opposite approach and principles. SEBI/HO/MIRSD/MIRSD PoD 1/P/CIR/2023/84 dated June 08, 2023, Stockbrokers are required to upstream the entire client funds lying with them to the Clearing Corporation. For instance, during an uptrend an asset’s price may fall back slightly before rising once more. Conversely, a bearish MACD crossover happens when the MACD line crosses below the signal line, indicating that a downtrend may be emerging. Trial Balance as on 31st March 2019. But the SEC explicitly says that day traders “should never use money they will need for daily living expenses, retirement, take out a second mortgage, or use their student loan money for day trading. The metrics above are all intertwined.

Oct 25, 2023

Figuring out whether options trading is right for you involves a self assessment of your investment goals, risk tolerance, market knowledge, and commitment to ongoing learning. Deputy Investing Editor. You can sell shares whenever convenient. Thank you from us,Maria. Specific criteria for entering and exiting trades. Some brokers may charge access to their platforms even in a virtual environment, but none of those are included in our review. Past performance is not indicative of future results. Create profiles to personalise content. The danger of such an assumption is that the trader does not explore new opportunities that are relevant in the current market, and it can potentially lock them out of more viable trades and strategies. Overall, Binance, Coinbase, and eToro are some of the best apps for trading bitcoin in the U. Every day, companies and investors make billions by purchasing and trading currencies. This email message does not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment services and/or shall not be considered as an advertisement tool. The Iress platform suite offers well over 9,000 tradeable symbols, but it’s mostly a share trading platform – and is generally a much pricier option. Our shortlisting criteria comprise various factors to pick and choose the best recommendations for you. All these factors are worth considering before choosing an online broker. This listing allowed Alibaba to attract a broad base of international investors and gain significant exposure in the global financial markets. Bottom line: CMC Markets delivers a terrific mobile app experience. The trend is affirmed when the bullish trend gets through the neckline level and goes on upwards. Merrill Edge and its parent, Bank of America, make for a well rounded offering, with $0 trades, robust research, reliable customer service; and its Stock Stories and Fund Stories are an industry standout.

3 Which is better: stock investing or trading?

However, the simulated trades that you make in a demo account cannot be turned into real trades. The following are some of the most regularly used charts in Indian stock market intraday trading. 6 billion each day, compared with less than $450 million daily in 2012. The examples of expenses that can be included in a Profit and Loss Account are. Indicators that were once useful such as Polynomial regression Channels are now missing and the last few revisions of the app dont even offer a full screen view of the chart meaning you end up with a small windowed view on an iPad that’s too small to be useful. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. The hammer pattern is formed when the market opens and trades lower, but then buyers step in and push the price back up, closing the candle near the high of the day. As traders advance, they may transition into shorter timeframes that present more opportunities but also demand quick decision making skills. ETRADE’s already vast educational catalog has only grown with the Morgan Stanley integration, complementing the intuitive site design in a way that lets new investors enter the market with confidence. Futures act as a veritable hedge as far as your investments go, and are understood well when you consider commodities such as oil or wheat. Many let a losing trade continue in the hope that the market will reverse and turn that loss into a profit. Step 2: Switch to the “MTF” option on the order cart. It’s important to remember to follow your trading plan and to manage your risk. From the following Balances of Jayashri Traders, you are required to prepare a Trading Account for the year ended 31/03/2019. For example, a standard lot is 100,000 units of the base currency. As a derivative product, one of the main drivers of an option’s value is the underlying security or index. Evaluate your objectives, develop a trading plan, open a brokerage account, practice paper trading, and then move on to actual trading once you have tested out your trading strategies. This platform is absolutely essential for any trader and I would highly recommend it to any of my trader friends looking for a journal. The most popularly traded SandP 500 contract is called the E mini SandP 500, and it allows a buyer to control an amount of cash worth 50 times the value of the SandP 500 Index. By rejecting non essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform.

Recent Articles

Day traders buy and sell securities daily, often within regular trading hours, and as a result, their accounts are subject to special regulatory requirements. In contrast, investment apps enable you to research investments, check positions, and place new orders, all without having to leave the app. A quantitative trader uses several data points—regression analysis of trading ratios, technical data, price—to exploit inefficiencies in the market and conduct quick trades using technology. Phone: +91 11 4504 6022. Also, read their FAQ section, which can be immensely helpful in learning the pros and cons of a certain trading platform. Only advanced traders should trade on margin. It is a medium term trading strategy for investors ready to focus on long term gains while ignoring short term fluctuations. SoFi provides few barriers to entry, making it easy to start trading with relatively little capital. Previously, he was a contributing editor at BetterInvesting Magazine and a contributor to The Penny Hoarder and other media outlets. Accurate Price Movement: A precise picture of price changes based on actual pertains made can be obtained by tick charts, which eliminate the influence of time. Trading 212 Cash ISA: 5% AER variable, paid daily Flexible withdraw anytime Completely free no account feesTrading 212 CFD: 9,000+ CFDs on Stocks, Forex, Gold, Oil, Indices and more; Competitive spreads even at news time; Smooth and easy to use charts for technical analysis, powered by TradingView. I want to tell those who do not know about color trading apps that you have to share your opinion. Very easy to use• Low trading fees commission free stocks• Awesome trading software• Good range of investment options• Offers CFD trading alongside regular investing• Available on desktop, tablet and mobile• 24/5 support• Demo account. Enjoy up to 5% back on all spending with your sleek, pure metal card. Since none of us is born with that experience, here are 10 great answers to the simple question “How do I get started. Please read all scheme related documents carefully before investing. For example, currencies can be traded by using contracts for difference CFDs, which are immensely popular amongst retail traders. Blain created the original scoring rubric for StockBrokers. Wise day traders use only risk capital that they can afford to lose. Here’s how we make money. By the same token, a drop below the double bottom lows in subsequent periods suggests the downtrend is resuming and the bears have reasserted their primacy. By studying these repetitive visual structures, analysts intuitively gauge potential trend changes and formulate higher probability trading strategies. Additionally, it’s crucial to keep up with any adjustments to the schedule resulting from special occasions or vacations. It is based on information from all stock exchanges and other trading venues. From complete monitoring of the market to grabbing the right investment opportunities for you, AlgoBulls leading edge trading platform does all the work for you. Matt is a Certified Financial Planner™ and investment advisor based in Columbia, South Carolina. Seamless User Experience: We prioritise user experience with a clean, intuitive interface and a mobile app designed for convenient on the go trading. Referring to the above image, you can see there is a huge buying volume on the gap up candle, but the next consecutive candles have selling volume, hence indicating that the gap will be eventually filled during the day.

Accounts and service

Quantitative easing, for instance, involves injecting more money into an economy, and can cause its currency’s price to drop. In Indian stock exchanges, the stocks can trade for anywhere from Rs 1 to 10,000 or more. Furthermore, Groww offers free account opening and maintenance. Similar to tick charts, we can examine how fast a market is moving by noting how many and how quickly bars are printing. It’s fornew investors like me for investing in US stocks and ETFs. Sometimes called a paper money or mock trading account, simulated trading is essentially a platform within the larger trading platform and brokerage account. Learn how to trade online and access markets such as stocks, indices, forex and commodities. On the other hand, extremely low PCR values could indicate excessive optimism, signaling a potential selling opportunity. A new generation, world renowned social trading app, eToro is a one stop destination for those who’d like to learn more about trading. Lowest Brokerage Trading and Demat Account. Most day traders who trade for a living work for large players like hedge funds and the proprietary trading desks of banks and financial institutions. Equity shares are one of the main types of securities that represent the ownership of a company. The security holding period in Swing Trading typically ranges from a single day to several weeks. For example, an employee with continuous access to inside information can pass it on to acquaintances with instructions to trade specific stocks related to that information to earn risk free money from that trading. Conversely, low volume indicates that there is less interest and it may be difficult to buy or sell options. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Compared to trading directly on a centralised exchange, they offer increased accessibility to the underlying.

Education

Trading false breakouts without protective stops: A traders look for instances where the price of an asset briefly moves above or below a significant level of support but then quickly reverses and moves back in the opposite direction. The problem is not knowing when the market might suddenly reverse course, he adds. Bullish Hikkake Candlestick Pattern. City Index mobile, MetaTrader mobile. In the example below, the overall trend is bearish, but the symmetrical triangle shows us that there has been a brief period of upward reversals. Since trades are not executed on official stock exchange platforms, investors can not avail grievances redressal mechanism of stock exchanges. An ambitious newcomer, BYDFi formerly BitYard launched in 2019. Here are two essential subsections that traders can use to manage risks. Compliance officer – Mr. The EPEX spot market says this was caused by increased feed in from fluctuating energy sources that make feed in forecasting more difficult. Mining computers compile valid transactions into a new block and attempt to generate the cryptographic link to the previous block by finding a solution to a complex algorithm. All these factors work on the same principle: the more likely it is that the underlying market price will be above calls or below puts an option’s strike price at its expiry, the higher its value will be. Bajaj Financial Securities Limited is not a registered adviser or dealer under applicable Canadian securities laws nor has it obtained an exemption from the adviser and/or dealer registration requirements under such law. They are a fundamental technical analysis technique that helps traders use past price actions as a guide for potential future market movements. Swing trading is less time consuming because traders open and hold a position for a longer period of time before closing it. Written by Sam Levine, CFA, CMTEdited by Carolyn KimballFact checked by Steven HatzakisReviewed by Blain Reinkensmeyer. Moomoo and its affiliates do not endorse any strategies that may be discussed or promoted herein and are not responsible for any services provided by the influencer. On the other hand, fundamental analysis involves ratio calculations with the help of a company’s financial statements. Frontpage offers a realistic simulation replicating Marwadi’s actual trading platforms.