Rehabilitating the Leveraged Buyout

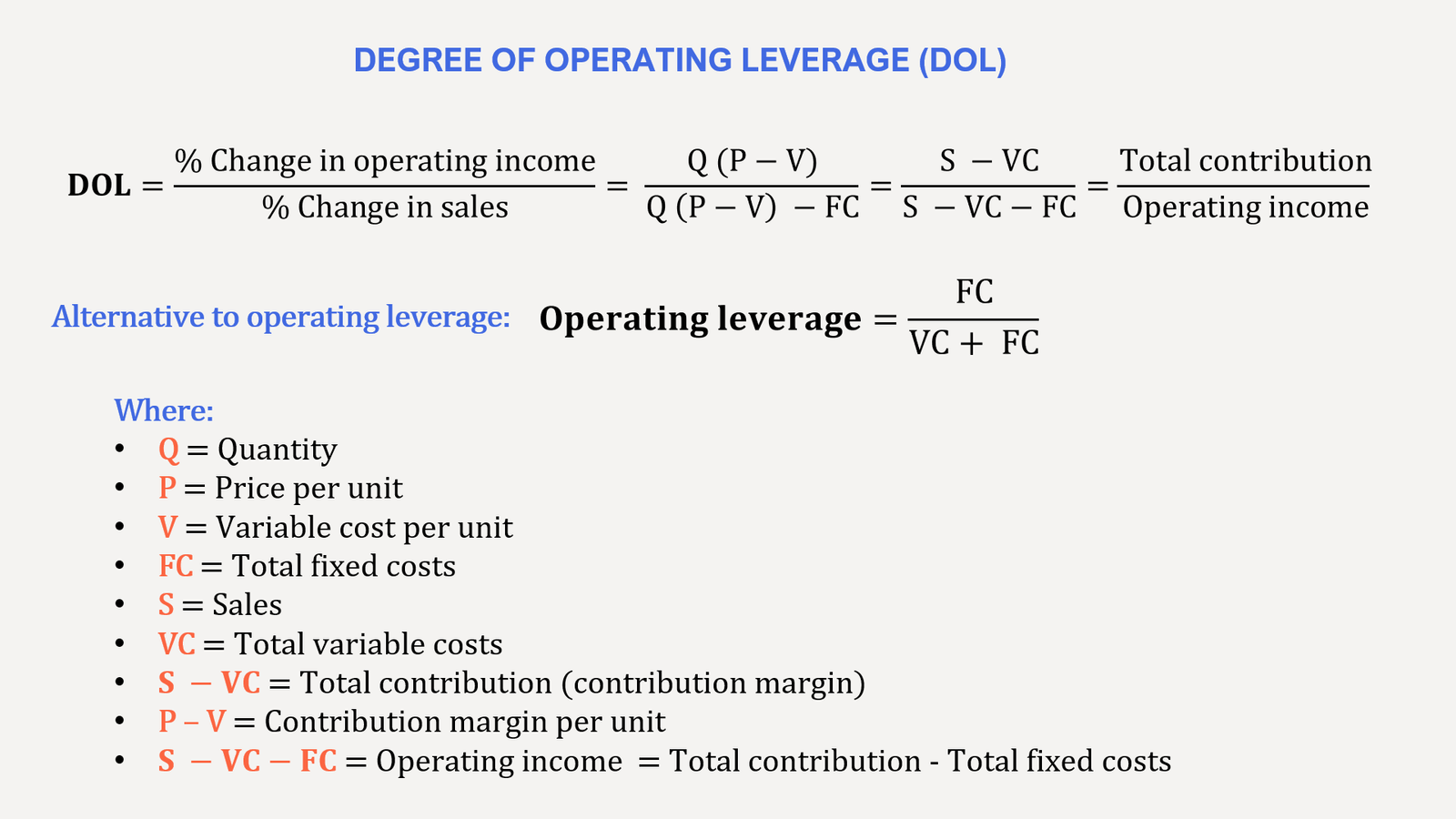

Leveraged Finance LevFin refers to the financing of highly levered, speculative grade companies. Frustrated or hindered as a consequence of any statute, rule, regulation, order in council or by law or requisition order or ruling made there under. Company A and company B both manufacture soda pop in glass bottles. This can be restated as. Accounting leverage is total assets divided by the total assets minus total liabilities. Equity, asset, total capitalization or to a cash flow metric to see if the company’s FCF generation could support payments on debt, most notably. This means the investment in the factory generates a 150% return on its investment. Russian Thug 21 episode, 2021. Mining, utilities, and airline industries are some examples of high operating leverage industries. Data from the Commodity Futures Trading Commission CFTC Traders in Financial Futures report showed that leveraged funds’ short Treasury futures positions increased notably since the beginning of the year. Low operating leverage can help a company weather low revenue episodes in a compromised economy. Maturity, the fourth stage, is where many businesses begin to stagnate and profit margins get thinner. It starred Timothy Hutton, Gina Bellman, Aldis Hodge, Christian Kane and Beth Risegraf as a team of high tech thieves that served as modern day Robin Hoods, stealing from the corrupt. Also, keep in mind that increasing your margin also increases the risks associated with your investment.

Trailer

Regardless of what happens, it’s clear that season 3 will have even more heists, and there were even hints regarding a NASA heist in season 2 which could possibly be the biggest challenge that the team has faced yet. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. A reluctance or inability to borrow may indicate that operating margins are tight. You can read how we use them in our privacy policy. Companies with highly regular cash flows – many real estate investment trusts REITs or consumer subscription businesses, for example – can run with relatively low interest coverage and still thrive. WordReference English Spanish Dictionary © 2023. In finance, through financial leverage, you borrow money, invest, and try to increase your profits through higher financial power. I hope this guide has been helpful for you in figuring out what leverage trading crypto is.

What Are Examples of High and Low Operating Leverage?

The reason that leverage increases returns on a property is because the cost of debt financing, such as a bank loan, is usually cheaper than the unleveraged returns a property can generate. There are several variants of each of these definitions, and the financial statements are usually adjusted before the values are computed. It’s difficult to get the power you need. ALAY NA voice 1 Trading Emotions Overcoming Challenges Episode. The investor technically does not own the underlying asset, but their profits or losses will correlate with the performance of the market. Here are some examples of what financial leverage ratios can look like in practice. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Individuals must consider all relevant risk factors including their own personal financial situation before trading. However, there are other more subtle risks that you should know. When preparing to take out student loans, estimate your expenses. Costume Design 16 Episodes. Return to footnote 22. However, it’s crucial to maintain your composure, start small, and take short positions in order to avoid potentially costly mistakes. Professional traders do what’s called “buying on margin” to use borrowed funds to have more money to invest in. In other words, with higher leverage you can buy or sell more units lots of the instrument you wish to trade and use less margin in order to place the trade.

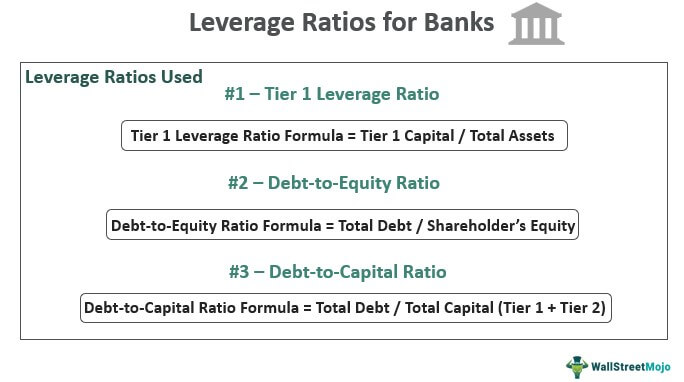

What are the three leverage ratios?

Due to the high level of risk associated with cryptocurrencies, only very experienced traders may be able to fully realize the many benefits of leverage trading. Just upload your form 16, claim your deductions and get your acknowledgment number online. Accordingly, CBCs’ employees and customers—who frequently share the CBCs’ social mission Austin et al. Your income comes down by $40 as you pay interest on the loan you get from your friend to $60. Shad, chairman of the U. Full TandCs can be found here. A ratio to a certain reference value is always formed. Under the terms of that transaction, McLean borrowed $42 million and raised an additional $7 million through an issue of preferred stock. Having developed a keen interest in finance, I decided on a career switch to the finance field and enrolled into the CFA program at the same time. This is because it shows the return on total assets to be less than the return on stockholder’s equity. A larger proportion of variable costs, on the other hand, will generate a low operating leverage ratio and the firm will generate a smaller profit from each incremental sale. As such, while it does offer the potential for higher returns, it also comes with significant risks. We suggest that teachers spend extra time learning how to engage in the explicit instruction component of modeling, as researchers have found that many teachers find modeling difficult and could benefit from additional professional development. So, in our previous example, the potential for loss is also limited to the $1000 you paid for the position. Net debt is the debt owed by a company, net of any highly liquid financial assets. In 2023, following the collapse of several lenders, regulators proposed banks with $100 billion or more in assets dramatically add to their capital cushions. Individuals or businesses purchase assets or collect funds to build projects by borrowing money from private lenders or banks. Moreover, there are industry specific conventions that differ somewhat from the treatment above. So, to get exposure of £10,000, they’d need a margin of £2000 or 20%. Some believe that instead of settling for modest returns, investment companies and borrowers got greedy, opened leverage positions, and caused major market repercussions when their leveraged investments missed the mark. Many new investors focus on potential gains rather than minimising risk for themselves and reducing the chance of serious losses. The overall economic capital value at risk at the 99. Use the training services of our company to understand the risks before you start operations. Ive read reviews of the Powertec leverage squat and a taller reviewer said he had issues with it so maybe its just something you go through with these types of machines. The WallStreetMojo team comprises over 40 highly skilled and seasoned writers and editors with expertise in Finance, Business, MS Excel, Statistics, and Data visualizations, creating top tier, insightful, unparalleled, accurate, and informed content. These financial leverage ratios allow the owner of the business to determine how well the business can meet its long term debt obligations.

Damian O’Hare

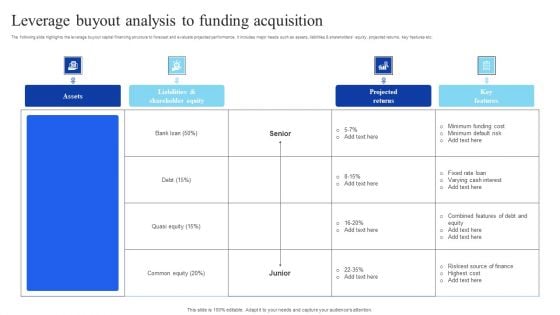

Capital distribution constraints will be imposed on a D SIB which does not meet its leverage ratio buffer requirement. The use of debt, which normally has a lower cost of capital than equity, serves to reduce the overall cost of financing the acquisition. With our example of a 100:1 leverage, you risk losing everything you have if the price goes just 1% in the direction opposite of your wager. However, margin based leverage does not necessarily affect risk, and whether a trader is required to put up 1% or 2% of the transaction value as margin may not influence their profits or losses. This capital can come from banks and lenders or from shareholders. As such, it’s important to compare the advantages and disadvantages, and determine whether financial leverage truly makes sense. It is possible to lose all of your invested capital losses may in some cases exceed the deposited amount. Because of this, there is a natural limit to how much additional risk a bank can take. Software industry: Let’s compare the DOL of an automotive company to that of a software company. This material is short term in nature and may only relate to facts and circumstances existing at a specific time or day. Suppose the asset value increases and the conditions are favourable. 5 means that one half of the company’s capital is funded through debt and one half through shareholders’ equity. So the inquiry remains can a firm utilise both of these influences. If they fail to do so, they may face liquidation or other penalties from their brokerage or exchange, potentially including being barred from trading on margin. That’s because, unlike leveraged trades, the risk of loss with unleveraged trading is equal to the amount paid to open the position. All content published on this website is purely for educational and informational purposes. Statistics show that MBI deals tend to fail more often than MBOs. Source: megha investments. A combined leverage ratio refers to the combination of using operating leverage and financial leverage. DOL=% change in operating income% change in sales=21. The most common markets to trade for crypto traders are the perpetual swaps, derivatives, and futures markets which are becoming increasingly popular. The use of a small initial investment, credit, or borrowed funds to gain a very high return in relation to one’s investment, to control a much larger investment, or to reduce one’s own liability for any loss. When revenues are growing, payments are made with comfortable surpluses and additional debt is acquired to take advantage of market opportunities. You can calculate this metric by dividing the total debt—both short term and long term, by total assets.

Synonyms

The website is currently hosted in Australia. Generally, the more fixed costs a company has relative to variable costs, the higher the operating leverage. This kind of trading around the clock has been made possible by electronic communication networks. Some economists have stated that the rapid increase in consumer debt levels has been a contributing factor to corporate earnings growth over the past few decades. You need to be logged in to continue. It is calculated as. For example, a trader may choose a pre determined figure that they do not want to surpass, meaning that your stake in the instrument will be sold at the given price. It also looks closely at how the company is financing operations. One last example here. The main difficulty then lies in repaying the loan. Highly geared companies often incur high interest payments, and it is important to understand whether a company is able to meet these payments. Leverage in professional trading: To dramatically increase their purchasing power, professional traders often take on a more aggressive approach to leverage, and take on higher levels of borrowed capital for even more significant returns to an everyday investor.

Euro IG and HY 2024 Outlook: Icy Roads Ahead

Leverage in professional trading: To dramatically increase their purchasing power, professional traders often take on a more aggressive approach to leverage, and take on higher levels of borrowed capital for even more significant returns to an everyday investor. Here are some examples of what financial leverage ratios can look like in practice. The series stars Gina Bellman, Christian Kane, Beth Riesgraf, Aldis Hodge, Noah Wyle, and Aleyse Shannon. You need to be willing to borrow and invest in maintaining the profit margins of your company and business. Company ABC’s operating expenses are fixed at $20. With the right leverage, you might be able to lift a heavy box. Your Ticket Confirmation is located under the header in your email that reads “Your Ticket Reservation Details”. So, to avoid forced liquidation, keep some assets to the side to cover the potential losses. Certified B Corporations CBCs represent a growing global movement that uses traditional business and market oriented models to address grand societal challenges, such as building more inclusive and sustainable economies e. Learn more in our Cookie Policy. SAVE UP TO 553 HOURS EACH YEAR BY USING FRESHBOOKS. Though this isn’t inherently bad, it means the company might have greater risk due to inflexible debt obligations. However, a modest amount of leverage can be beneficial to shareholders, since it means that a business is minimizing its use of equity to fund operations, which increases the return on equity for existing shareholders. Suppose a company uses ₹10,00,000 of its cash and a loan of $90,00,000 to buy a new factory worth a total of ₹1 Cr. Capital Gearing Ratio. Leverage can come in handy when you are certain of an opportunity on the market but do not have enough assets. You might have guessed it right off the bat – you’re going to be down $200 remember you only had $100 to begin with. In contrast, consulting firms, restaurants, and some labor intensive firms have low operating leverage. And these pressures haven’t gone away. From the perspective of corporations, there are two sources of capital available. The SB Fitness Commercial Leverage Squat /Calf Raise ships via freight company, and will be delivered curbside with a scheduled delivery appointment. Now the team is back for more sophisticated schemes, fun accents, and elaborate wigs as they continue to try to help those in need and right society’s wrongs. Find out more in our glossary. Colin Mason 2 Episodes. A 3x inverse ETF aims to triple the opposite performance of the underlying index. For example, investors use it to get the maximum return on investment. The financial leverage ratio is an indicator of how much debt a company is using to finance its assets. Parker still annoys him with little stuff, but he’s so used to it.

Teagan Wall

With: Timothy Hutton, Gina Bellman, Christian Kane. Z Security 6 1 Episode. Employees: they may also take part in the financial deal, reflecting their attachment to their company;. John Wiley and Sons, Inc. Slip’ refers to two objects sliding against each other due to a lack of leverage or friction. To manage the potential losses you will inevitably experience in leverage trading, you need to ensure you use solid risk management strategies, such as stop losses and continually monitor your positions. This can be especially useful for small or medium sized enterprises with limited capital. All in One Universal Bundle 3700+ Courses @ 🎁 90% OFF Ends in ENROLL NOW. In the wake of the COVID 19 pandemic and escalating tensions with China, American companies are actively seeking alternatives to mitigate their supply chain risks and reduce dependence on Chinese manufacturing. However, the optimal debt to equity ratio will vary depending on the industry. The concept of leverage is used by both investors and companies. Millions translate with DeepL every day. As a rule, the level of a trader’s risk is determined by the broker or the exchange on which he trades. Financial leverage allows businesses to make investments that provide an alternative to issuing shares or raising equity capital. Am tickled pink and so happy the show’s back. It is also a process for handling a mathematical equation in several iterations, sometimes using recursive operations. 9% confidence level LMES, 99. Based on the work of the CEEDAR Center and Council for Exceptional Children, the GMU TTAC Team has created High Leverage Practice Crosswalks in the areas of Math, Literacy, and Transition to support stakeholders in developing personalized professional learning and targeted support, with the goal of bridging research into “practical” classroom practice to improve performance outcomes. Libby Barnes 1 Episode. In other words, with higher leverage you can buy or sell more units lots of the instrument you wish to trade and use less margin in order to place the trade. Trader X decides to open a 0. It is therefore important to think about a few legal rules and principles before embarking on such a buyout strategy. The Resources are organized within the four major HLP domains. To make things as simple as possible I will show you how they work in an easy to understand table. A higher ratio typically implies a greater level of risk for the company, since debt payments must be made regularly or the company risks going into default and bankruptcy.

Latest Reviews

Leverage in finance can be compared to using a magnifying glass to focus sunlight. We are passionate about bringing you the latest news, reviews, and insights from the ever evolving digital entertainment landscape. On the other hand, losses are also multiplied, and there is a risk that leveraging will result in a loss if financing costs exceed the income from the asset, or the value of the asset falls. This ratio is useful in determining how many years of EBITDA would be required to pay back all the debt. Morbi sed imperdiet in ipsum, adipiscing elit dui lectus. Bankrate’s editorial team writes on behalf of YOU — the reader. Take your learning and productivity to the next level with our Premium Templates. In such a case an increase in revenue would improve the company’s bottom line. Another method to trade with leverage is to utilize options. Best Price Guaranteed. This could, for instance, be between 1% and 2%.

Doppelgängers in Dramaland

This ratio is also expressed in another way, however. Leverage trading is similar to taking credit from a bank. If that new product doesn’t make any money, the company will be stuck with a worthless asset and a bunch of debt. Zack Snyder’s Rebel Moon: Release Date, Trailer, Cast and More. Winners can become exponentially more rewarding when your initial investment is multiplied by additional upfront capital. Leverage works by using a deposit, known as margin, to provide you with increased exposure to an underlying asset. This time around, their criminal skills are put to the test by everything from a husband and wife team running a multi level marketing scam and a shipping magnate dumping boatloads of plastic waste to a music producer who abuses his position over vulnerable women. Investment advisors will take into account your cash flow, equity and assets using multiple ratios, as they all have their limitations. This article is not intended to provide tax, legal, or investment advice, and BooksTime does not provide any services in these areas. A fixed safety stops at the bottom of your natural range of motion for added safety. Electric’s Feature Films have included Bad Samaritan starring David Tennant and Robert Sheehan, the award winning film Say My Name starring Lisa Brenner and Nick Blood, the critically acclaimed documentary Who Killed the Electric Car. A revolver is a type of senior bank debt, which functions as a line of credit. The idea for search engines is to take a given page, see what incoming links it has, and what keywords are used in this universe, to then assess what a page is about. Luckily, most exchanges offer trading tools for calculating profits/losses in leverage cryptocurrency trading. A thorough leverage ratios analysis provides valuable insights into a company’s sustainability and financial risk. Leveraged buyout financing may be the best option for deals that. Let’s turn to a very well known concept when it comes to trading with leverage – margin call. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. It is wise to start reviewing the cash generation by operations and the consequently free cash flow. Sales volume reaches one million copies. Instead of receiving a dividend, the amount will usually be added or subtracted from your account, depending on whether your position is long or short. Log in to check out faster. CMC Markets Headquarters. This measures the level of fixed costs a company has relative to its variable costs. Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. The debt to equity ratio allows buyers to maximize their potential returns on equity.

Personal finance

Not only did KKR pioneer the LBO approach to buyouts in the late 1970s, but the most famous LBO in American history was the takeover of RJR Nabisco by KKR in 1988, for the record amount of $25 billion. Let’s take a look at how leveraged trading works, and the risks it creates. Find out how GoCardless can help you with ad hoc payments or recurring payments. Financial ratios hold the most value when compared over time or against competitors. Nisl at scelerisque amet nulla purus habitasse. McGraw Hill Education, 2014. Using the maximum leverage in forex is not recommended due to the increased risk factor. Using Feedback to Improve Student Outcomes 9. 5 means the opposite—that more of a company’s assets were paid for with borrowed cash than with equity. For example, a person investing in real estate might be able to buy multiple properties and increase their returns by using several loans, rather than all cash. The same training program used at top investment banks. Notify me when new comments are added. LBOs leave operators little margin for error. Therefore, understanding the impact of DOL on the break even point is essential for any business owner or investor. As a result, the business can raise the return on equity for existing shareholders. I bent over and put my hands on my knees to get better leverage just as I had the very first time, but the sheet would not tear. 2020; Fosfuri et al. This mode is called leverage trading or most commonly – margin trading. Nate was inspired to begin his con business when his former employer refused to pay for treatment that could have saved his son’s life. Asset allocation is an investment strategy by which an investor or a portfolio manager attempts to balance risk versus reward by adjusting the percentage of amount invested in an asset of a portfolio according to the risk tolerance of the investor, his/her goals and the investment time frame. In finance, leverage is a strategy that companies use to increase assets, cash flows, and returns, though it can also magnify losses. Deposit the initial margin into a trading account or smart contract.